As the Federal Grad PLUS Loan program sunsets in 2026, graduate and professional students will face an unprecedented shift: private lenders will play a much larger role in funding advanced degrees. For the first time in decades, borrowing for graduate school will depend not just on enrollment and need—but on credit strength and borrower profiles.

Understanding what lenders see in your credit report, how your score compares to national and graduate-student averages, and what those numbers mean for loan approval can help you prepare strategically.

📘 For detailed tips on building your credit before you apply, read our companion guide: Credit Matters: Preparing Your Credit Score for Graduate School Borrowing.

What a Credit Score Is—and Why It Matters for Grad-School Borrowers

A credit score is a three-digit number—typically ranging from 300 to 850—that represents your creditworthiness, or the likelihood you’ll repay borrowed funds on time. Lenders use this number to determine your interest rate, loan approval, and overall credit limit.

According to the Consumer Financial Protection Bureau (CFPB), your credit score is based on five major factors:

- Payment history (on-time payments)

- Amounts owed (credit utilization)

- Length of credit history

- New credit inquiries

- Credit mix (types of accounts you hold)

A higher score generally unlocks lower interest rates and fees, while a lower score can mean fewer loan options, higher costs, or the need for a cosigner.

How Lenders Evaluate Graduate-Student Credit Profiles

Private lenders increasingly combine credit scores, debt-to-income ratios (DTI), and education-related data (program type, degree ROI, career trajectory) when assessing applications.

- Credit-Score Tiers:

- 740–850: Excellent – top-tier borrowers qualify for the lowest rates.

- 670–739: Good – considered “prime,” typically eligible for favorable rates.

- 580–669: Fair – “near-prime”; may face higher APRs or require a cosigner.

- Below 580: Limited options or likely denial.

- DTI Ratios: Most private lenders prefer DTI < 40 percent, meaning your monthly debt payments (credit cards, rent, student loans) should not exceed 40 percent of your income. (CFPB Debt-to-Income Guidance)

- Program of Study: Some lenders, especially those using outcome-based underwriting, factor in career-earnings data from the U.S. Department of Education (DOE) National Center for Education Statistics (NCES) and Bureau of Labor Statistics (BLS) Occupational Outlook Handbook to evaluate repayment potential.

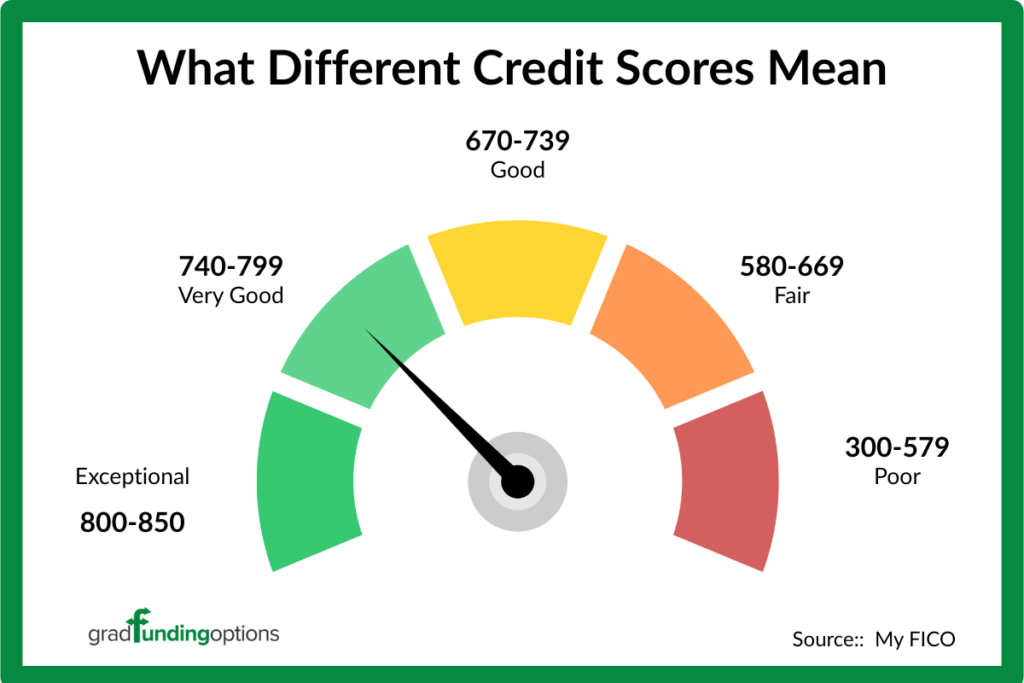

What Different Credit Scores Mean (FICO Scale)

| Score Range | Label | What It Means for Borrowers |

|---|---|---|

| 300–579 | Poor | Most likely can’t borrow or will require a strong cosigner. |

| 580–669 | Fair | Higher interest rates; limited lender options. |

| 670–739 | Good | Qualifies for fair-market interest rates. |

| 740–799 | Very Good | Favorable terms and wider loan selection. |

| 800–850 | Exceptional | Access to lowest interest rates and fees. |

Average Graduate-Student Credit Scores in 2025

Graduate-student borrowers in 2025 tend to fall in the “good” to “near-prime” category (mid-600s to low 700s). While older borrowers maintain slightly stronger profiles, younger students entering professional programs have seen declines since federal loan repayment reporting resumed in 2025.

- National Average FICO: ≈ 715 (Experian, 2025)

- Graduate-Age Borrowers (18–29): ≈ 676 (CFPB & FICO, 2025)

- Historical Graduate Degree Holders: ≈ 741 (Experian long-term trend)

These scores remain healthy but highlight tighter lending conditions ahead—especially as Grad PLUS disappears.

2025 Average Age and Predicted Credit Scores of Graduate Students

| Program Type | Average Age (2025) | Predicted Average Credit Score (2025) |

|---|---|---|

| Traditional Master’s (Full-Time) | 25 | 670 |

| Law (J.D.) | 25 | 670 |

| Medicine (M.D./D.O.) | 25 | 670 |

| MBA | 28 | 676 |

| Doctoral Programs (Ph.D./Ed.D.) | 33 | 676 |

| Online / Part-Time | 35 | 676 |

| All Graduate Students (Average) | 33 | 676 |

Sources: Experian, CFPB, DOE, Council of Graduate Schools, LSAC, AAMC (2025).

Interpretation: Younger borrowers in law, medicine, and traditional master’s programs are most likely to need a cosigner due to shorter credit histories. Older or part-time students tend to have higher scores, reflecting longer financial experience and established repayment histories.

What These Numbers Mean for Private Graduate-Student Lending

- Many Borrowers Are “Good” but Not “Prime.”

With average FICO scores near 676, most graduate borrowers sit just below the tier that earns the best rates. - Cosigners Are Still Common.

The College Board’s “Trends in Student Aid” (2025) shows roughly 90 % of private graduate loans are approved with a cosigner, underscoring the gap between borrower potential and traditional credit underwriting. - Rate Gaps Can Be Substantial.

A difference of 50 credit-score points can shift interest rates by 1–2 % points— thousands of dollars in lifetime costs. - Outcome-Based Underwriting Is Emerging.

Some fintech and credit-union lenders are integrating program ROI and career income data (Brookings & TICAS research) to expand access for capable but “thin-file” borrowers.

Quick Ways to Strengthen Your Credit Before Borrowing

Even if your score is average, consistent habits can boost it before applying for private loans:

- Pay on time: Set up autopay or reminders.

- Keep balances low: Ideally < 30 % of credit limit.

- Avoid unnecessary new credit: Limit hard inquiries six months before applying.

- Maintain older accounts: Credit age improves your profile.

💡 Learn the full step-by-step strategy in our guide: Credit Matters: Preparing Your Credit Score for Graduate School Borrowing.

From Credit Awareness to Borrowing Readiness

Knowing what lenders see in your credit file—and how graduate borrowers compare nationally—can help you plan ahead and borrow more strategically. In 2025, most graduate students fall within the “good” range, but small improvements can unlock major savings and increase approval odds.

As Federal Grad PLUS loans phase out, your credit score, debt management, and program choice will shape your borrowing power. Building even a modestly higher score before you apply can expand your lender options, lower your costs, and increase financial independence—whether you borrow solo or with a cosigner.

Leave a Reply