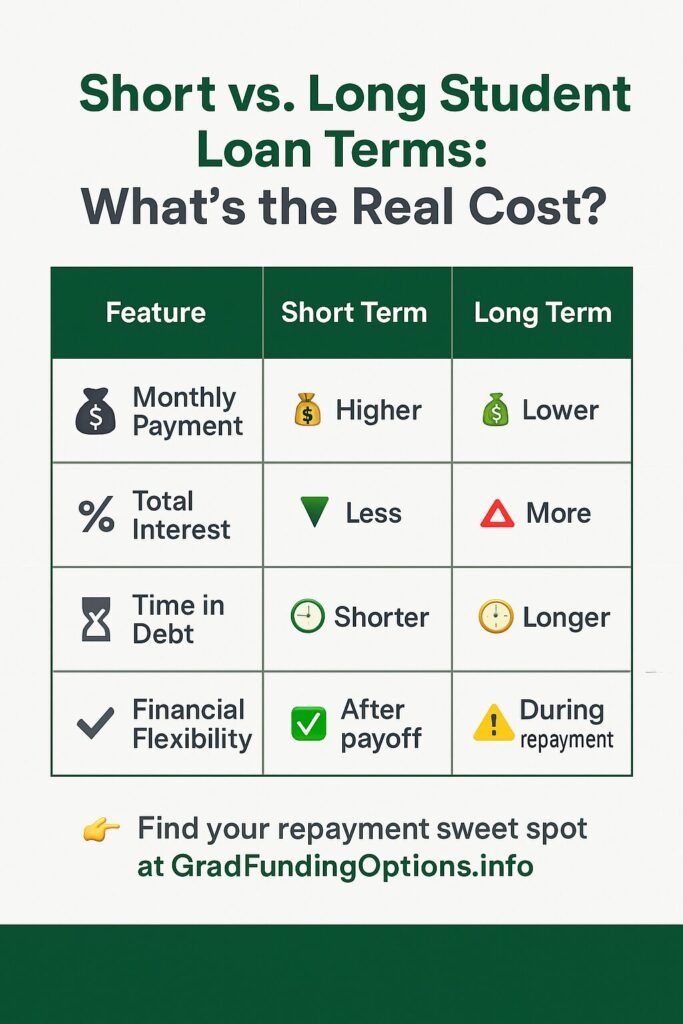

When it comes to repaying graduate or professional school loans, one of the most important choices you’ll make is how long to take to pay them off. The loan term you select — whether short or long — directly affects your total interest cost, monthly budget, and overall financial flexibility.

Below we explore the pros and cons of accelerated repayment versus stretching out payments — and how your decision can shape long-term financial freedom.

Accelerated Repayment: Short Graduate Student Loan Term

Choosing a shorter repayment term means committing to higher monthly payments so you can eliminate debt faster.

Pros

- Significant interest savings: Paying off your loan sooner dramatically reduces the total interest paid over time. According to the Consumer Financial Protection Bureau (CFPB), even one extra payment per year can shorten your loan term and cut thousands in interest costs.

- Earlier debt freedom: Finishing payments ahead of schedule frees up income for savings, investing, or major life goals.

- Improved credit health: A lower debt-to-income (DTI) ratio strengthens your credit profile — a key factor lenders use for future approvals.

- Increased financial flexibility: Once debt is cleared, you can redirect funds toward long-term wealth building.

Cons

- Higher monthly payments: A shorter term increases the monthly payment amount, which can strain a tight budget.

- Reduced cash flow: You’ll have less money available for emergencies or discretionary spending while aggressively repaying.

- Less cushion for risk: If income fluctuates or an emergency occurs, higher payments can create financial stress.

- Possible prepayment penalties: Some private lenders still charge early payoff fees — check your loan agreement carefully before making extra payments.

Smart Strategies for Accelerated Repayment

- Make biweekly payments: Paying half your monthly amount every two weeks results in one extra full payment each year.

- Pay extra toward the principal: Even small increases — like rounding up to the nearest $50 — can shorten your term.

- Try the “debt avalanche” method: Pay off the highest-interest loan first while making minimums on others for maximum savings.

Stretching Out Payments: Long Loan Term

Opting for a longer repayment period spreads payments over more years, resulting in smaller monthly bills — but more total interest.

Pros

- Lower monthly payments: Extending the term offers breathing room for everyday expenses or savings goals.

- Greater budget flexibility: More cash each month can help manage other priorities, like contributing to a 401(k) or emergency fund.

- Reduced stress: Smaller payments can offer peace of mind, particularly for early-career professionals managing variable income.

Cons

- Higher lifetime cost: The College Board notes that borrowers who extend repayment terms can pay tens of thousands more in total interest.

- Longer time in debt: You’ll carry your loan longer, delaying financial independence.

- Decreased flexibility later: A long-term payment obligation can crowd out future financial goals such as saving for a home or children’s education.

- Complacency risk: Smaller payments can make repayment feel less urgent, slowing progress.

Smart Strategies for Managing Long-Term Debt

- Consolidate or refinance wisely: If you have multiple loans, consider combining them for a single, lower rate — but weigh the trade-offs carefully.

- Use the “debt snowball” method: Pay off your smallest balance first to stay motivated, then roll payments into the next loan.

- Explore income-driven repayment (IDR) options: For federal loans, plans like SAVE or PAYE can cap payments at a percentage of income, though you’ll pay more interest over time.

How Loan Term Length Affects Total Interest

The U.S. Department of Education illustrates this clearly:

- A $60,000 loan at 7% interest repaid over 10 years results in roughly $23,500 in interest.

- Stretching that same loan to 20 years nearly doubles total interest to $50,400.

Choosing the right term means balancing affordability with total cost — not just monthly comfort.

Finding Your Repayment Sweet Spot

There’s no one-size-fits-all answer. For some, early debt freedom outweighs temporary budget strain. For others, lower payments provide necessary flexibility to build stability first.

The key is to align your repayment strategy with your income trajectory, financial goals, and risk tolerance. You can always start with a longer term and increase payments later as your earnings grow.

Bottom Line

Your repayment term is more than just a number of years — it’s a reflection of your priorities. Whether you accelerate repayment or stretch it out, understanding the true cost of time and interest helps you make smarter decisions that support long-term financial well-being.

For more insights, explore:

Leave a Reply